Last week we discussed how to set up your paypal account. This week let’s discuss how to manage your account.

When a paypal account is set up, it really gives you another account. It’s not your bank account, it is a paypal account. This paypal account is used for deposits (you sell something) and withdrawals (you buy something). Transactions done using paypal results in money being transferred in and out of this account. If you make a purchase and no money is in your paypal account, you will be prompted by Paypal to withdraw funds from your bank account or use a credit card.

When you sell a product or service using Paypal, the money from the transaction is placed in your paypal account, not your bank account. There is an additional step to transfer the balance in your Paypal account to your bank account. It is simple to do, but it is not an instant transfer. It can take up to several days for the money to show up in your bank account.

To transfer money from your paypal account to your bank account

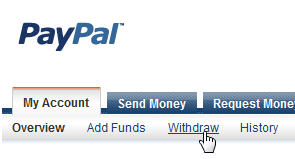

It is assumed that you have already linked a bank account to your paypal account. To transfer funds from your paypal account to your bank account, sign into your account and select the “withdrawal’ tab.

Click on the account you want to transfer the money to, enter the amount to transfer and click submit.

Transfers from your paypal account to any bank account is free and can take up to 3 to 4 days.

You can also set up an option within your paypal account to have moeny automatically transferred to your bank account on a daily basis. There are pros and cons to do this. For more info, see this post on Tamebay.com: PayPal add ability to auto withdraw funds daily

What is your experience in managing your paypal account?

Banks borrow money by accepting funds deposited on current accounts, by accepting term deposits, and by issuing debt securities such as banknotes and bonds.

The duration of the loan period is considerably shorter often corresponding to the useful life of the car. There are two types of auto loans, direct and indirect.